Following the long-lasting rule of the accidental prime minister, the BJP seized control of India’s sovereignty, with Narendra Modi serving as the country’s face as prime minister. With the BJP party’s democratically elected rule, the government intended to implement some reforms to change the country’s economic policies and provide more opportunities for young and upcoming business and entrepreneurs. The new India sought to broaden its horizon and allow more business to settle in order to avoid becoming oligopolistic.

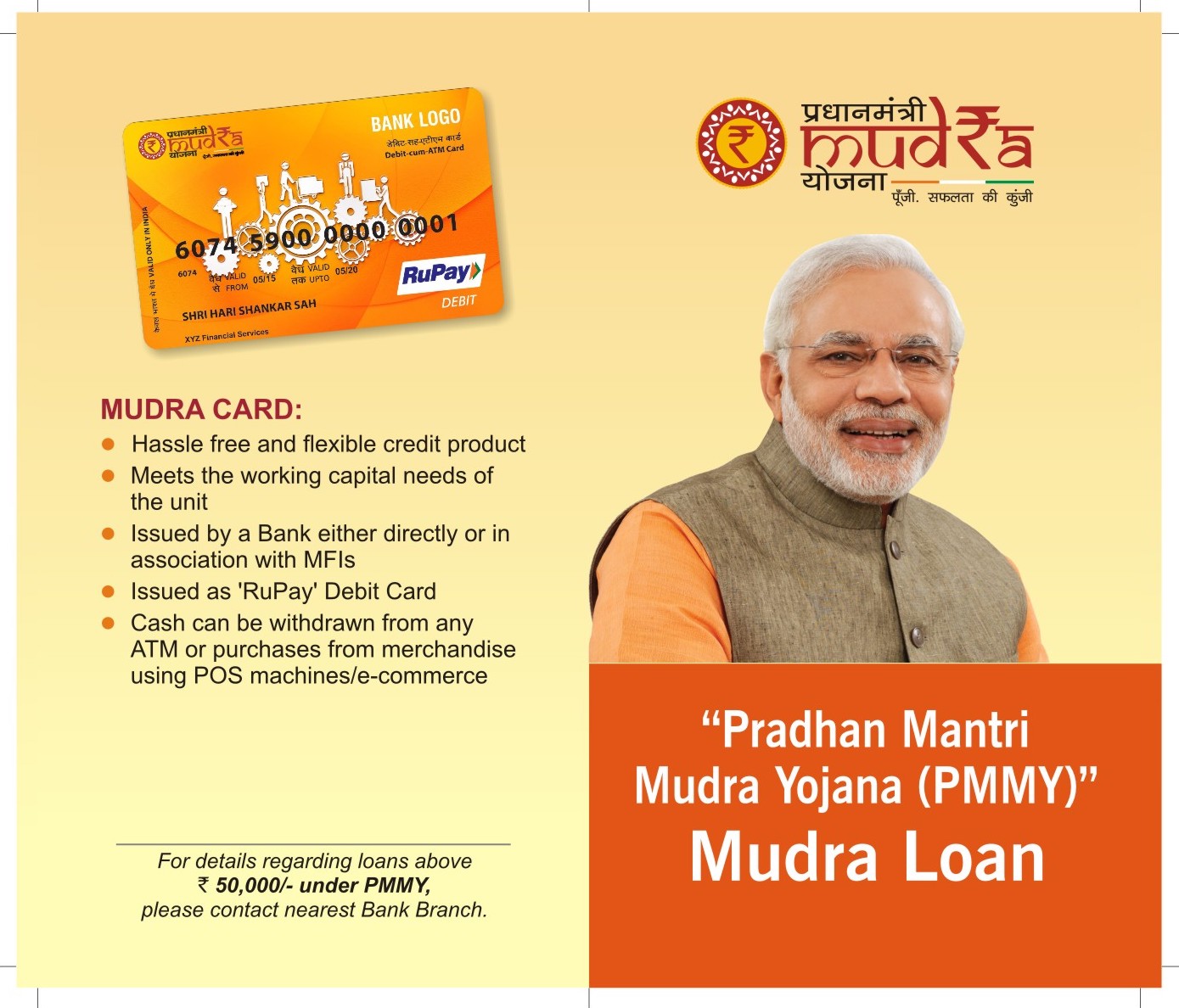

Many new schemes were introduced with the formation of this new government, including the Jan Dhan to Jan Suraksha, Pradhan Mantri Jan Dhan Yojana, Atal Pension Yojana, and many others. However, one scheme stands out above the rest: the Pradhan Mantri Mudra Yojana. This scheme was implemented in 2015, a year after the Modi government took office. The programme was designed to provide loans to micro and small businesses. The loans are given without any collateral and are intended to improve the beneficiaries’ livelihoods by creating job opportunities, promoting entrepreneurship, and improving beneficiaries’ livelihoods.

Many new schemes were introduced with the formation of this new government, including the Jan Dhan to Jan Suraksha, Pradhan Mantri Jan Dhan Yojana, Atal Pension Yojana, and many others. However, one scheme stands out above the rest: the Pradhan Mantri Mudra Yojana. This scheme was implemented in 2015, a year after the Modi government took office. The programme was designed to provide loans to micro and small businesses. The loans are given without any collateral and are intended to improve the beneficiaries’ livelihoods by creating job opportunities, promoting entrepreneurship, and improving beneficiaries’ livelihoods.

In India, small and micro businesses face a number of challenges, including limited access to credit and financial resources, which prevents them from expanding and growing. The PMMY scheme was created to address these issues by providing small and micro businesses with loans with no collateral. Loans are available in several categories, including Shishu, Kishore, and Tarun, to meet the needs of various segments of micro and small businesses. The loans are classified in order to meet the various needs of micro and small businesses. Loans were classified based on the size, turnover, and credit requirements of the businesses.

The first type of loan that this scheme provides is “Shishu” It is designed for businesses in their early stages of development and provides loans up to Rs. 50,000. Next is the “Kishore” It is intended for micro and small businesses that have progressed beyond the Shishu stage and require more credit. This category of loans ranges from Rs. 50,000 to Rs. 5 lakh. The Kishore category is especially useful for small businesses that have a good track record but are unable to obtain traditional bank loans due to a lack of collateral or credit history.

Lastly, comes the Tarun scheme, It is designed for established micro and small businesses that have a higher credit requirement and are looking to expand further. Loans under this category range from Rs. 5 lakh to Rs. 10 lakh. All of these loans are used to provide support to businesses engaged in a wide range of activities, including agriculture, trading, manufacturing, and service sectors. The loans can be used for various purposes, such as working capital, machinery purchases, and other business-related expenses.

As of April 2022, the government of India has distributed around 34.42 crores in loans, additionally this has helped in reducing the unemployment in India, thereby increasing the overall GDP of India in the long run, by providing small-scale, micro-enterprises with initial credit facilities. Additionally Informal business have been included into the formal economy, new ventures of business, the scheme will on the one hand employ millions and on the other will broaden India’s overall tax base, because till today the informal economy of India remains untaxed and rarely monitored. The scheme also expands India’s financial inclusion It intends to use information technology to reach its credit delivery mechanism to micro-businesses and industry in even the most remote parts of the country.

The establishment of the MUDRA bank, as envisaged under this scheme, will greatly aid in the management of the network of micro-finance institutions through consistent regulations. The new registrations made possible by this scheme will help to strengthen the country’s banking institutions. With the introduction of this scheme, many small business have the opportunity to import goods from foreign markets, this has allowed integration of global business into smaller markets and therefore has made the integration of globalisation even easier.

Additionally, the Center has begun to distribute 10 lakh jobs this year. In the Employment Provident Fund Organization (EPFO), new accounts (UAN) numbers were opened on average at a rate of 15 lakh. 12.94 lakh new employees joined EPFO in October of previous year, followed by 15.42 lakh in September, 16.94 lakh in August, 18.23 lakh in July, 18.36 lakh in June, 16.82 in May, and 17.08 lakh in April. The table below gives the state-state analysis of the number of loans sanctioned by each state.

If compared to the list of poorest states in India

The number of states that have benefited from this plan is displayed in the table above. When compared to the states on our list of the poorest states The second-poorest state in India is Jharkhand, as can be observed. This further demonstrates how the introduction of this scheme has acted as a way of light to many of these states that are in low economic conditions and are now getting opportunities to earn money to feed their families and aid in India’s economic growth. India is ranked 15th for the state to take the most loans on top as well as the likes of Bihar and Assam, considered to be one of the poorest states in India are taking massive loans. The many employment opportunities have helped the people of Bihar, Jharkhand and Assam and therefore In India, many of the workers that are responsible for infrastructural development come from this region.

In response to the shifting economic and commercial climate, it is anticipated that the landscape of MSME schemes would change and broaden in the future. The MSME sector is poised to undergo considerable transformation and expansion with the arrival of digital technologies. The government is probably going to put a lot of effort towards digitalization and technology integration in the MSME sector in order to boost productivity, expand market access, and boost MSMEs’ competitiveness in general. Future government actions are anticipated to help MSMEs’ expansion and advancement, notably in the fields of finance, technology, marketing, and human capital development. Additionally, entrepreneurship promotion and aiding start-ups and new firms may receive more attention.